wells fargo class action lawsuit fake accounts

The bank conceded that it made millions by setting up fake accounts and the complaint sets forth many facts about the internal pressure the bank put on employees to make sales quotas. In 2016 and 2017 the Wells Fargo fake accounts scandal made headlines across the country.

Wells Fargo Fake Account Lawsuit Settles For 110 Million Fortune

28th of March 2017 Wells Fargo agreed to shell out 110 million as a class action settlement for the class action lawsuits that accused them of registering customers for accounts they didnt consent to and never knew about.

. This includes misleading marketing and poor customer service. A Seattle resident has filed a proposed class action in which he claims to have been the victim of a scam targeting Wells Fargo Bank customers who use the Zelle app. Wells Fargo agrees to 3 billion settlement over fake accounts The bank has agreed to admit wrongdoing as part of the deal.

In the end Wells Fargo agreed to pay 142 million to the affected parties. The company has since revised its public descriptions of its sales practices. Wells Fargo is currently facing -- and trying to get out of -- a dozen class action lawsuits involving a fake account fiasco that saw bank employees opening millions of.

If you were Wells Fargo customer or Wells Fargo employee and were involved in the fake account crisis that was recently reported in the news please contact us. Furthermore you can find the Troubleshooting Login Issues section which can answer your. On top of that two former Wells Fargo employees are seeking 26 billion for current and former bank employees who were punished because they didnt meet Wells Fargos unrealistic quotas The suit is claiming that the bank promoted employees who made their quotas by setting up fake accounts while those who didnt take part were demoted or fired.

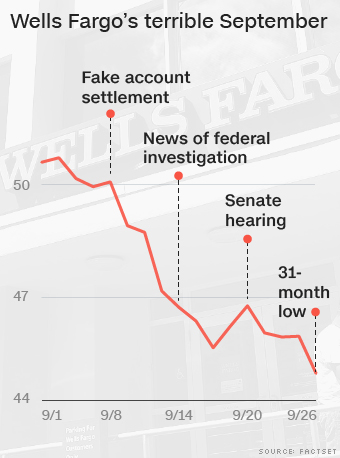

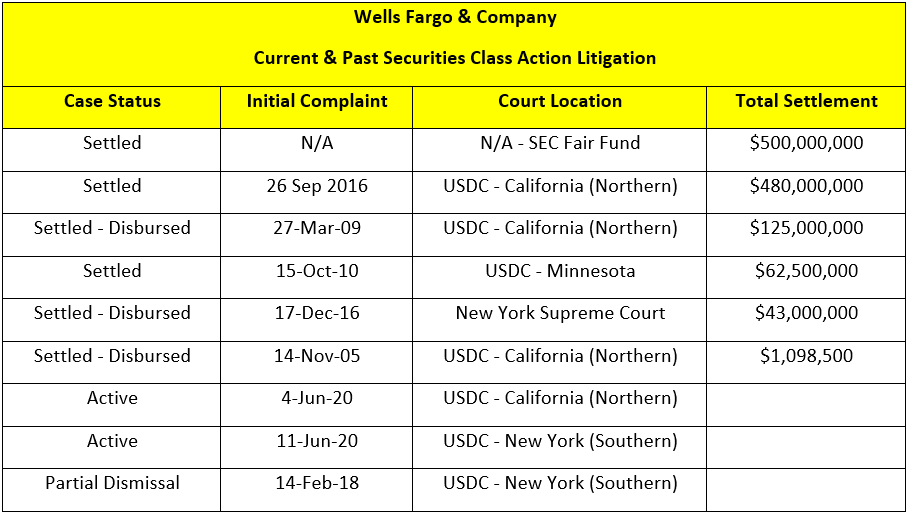

In 2018 one class action settlement did resolve some claims against Wells Fargo in relation to its fake accounts scandal. Other lawsuits are still pending. Wells Fargo said Friday it will pay 480 million to settle a lawsuit filed by investors related to the banks 2016 sales scandal involving the opening of.

Affected consumers have settled class action litigation against Wells Fargo that has resulted in tens of millions of dollars of restitution. Fill out the form on this page or call. In the settlement Wells Fargo agreed to pay 142 million to consumers who had an unauthorized account opened in their name between May 1.

The fake accounts scandal centered around employees of the bank that were opening unauthorized additional credit card and bank accounts for current customers of the financial institution. Wells Fargo Unauthorized Account Lawsuit will sometimes glitch and take you a long time to try different solutions. Seattle resident Luke Hartsock claimed he was scammed out of.

On May 13 2015 Keller Rohrback LLP. A class-action lawsuit launched against banking giant Wells Fargo and digital payments network Zelle was dropped Law360 reported. Class action alleges Wells Fargo earned millions in illegal fake accounts.

Christopher DiltsBloomberg News Placeholder while. The Wells Fargo Settlements Timeline. Filed a class action lawsuit against Wells Fargo alleging the bank victimized its customers by using illegal fraudulent and deceptive tactics to boost sales of its banking and financial products.

The lawsuit against Wells Fargo cites multiple instances of the banks failure to disclose material information to consumers. Additionally these same employees also signed patrons up for. WFC investors that a class action has been filed on.

Wells Fargo Customers and Employee Class Action Investigation. By Alexander Mallin and Justin Doom. LoginAsk is here to help you access Wells Fargo Unauthorized Account Lawsuit quickly and handle each specific case you encounter.

This complaint chronicles the Wells Fargo scam account lawsuit. August 8 2018. The 21-page lawsuit says that although the type of Zelle scam to which the plaintiff fell victim is well known to the collection of banks including Wells Fargo who own the.

LOS ANGELES June 29 2022 GLOBE NEWSWIRE -- The Portnoy Law Firm advises Wells Fargo Company Wells Fargo or the Company NYSE. Wells Fargo has reached a 3 billion settlement with federal regulators over its creation of fake accounts in 2016. While much of the fake account scandal was unfolding the public lacked a government watchdog dedicated to policing financial products and services.

28m Wells Fargo Settlement Resolves Call Recording Claims Top Class Actions

Los Angeles Sues Wells Fargo Over Fraudulent Conduct In Face Of Sales Pressure Los Angeles The Guardian

Wells Fargo Paying 3 Billion To Settle U S Case Over Illegal Sales Practices Npr

Wells Fargo To Pay 3b To U S To Settle Fake Accounts Scandal

Fired Wells Fargo Workers File Federal Class Action Lawsuit Seeking 7 2 Billion Wells Fargo Fargo Bank Branch

Keller Rohrback L L P Wells Fargo Agrees To Pay 110 Million To Resolve Consumers Class Action Lawsuit About Unauthorized Accounts Keller Rohrback

Wells Fargo To Pay 3 Billion Over Fake Account Scandal

Wells Fargo To Pay 575m Settlement For Setting Up Fake Banking Accounts Us News The Guardian

Wells Fargo To Pay 3 Billion To Doj Sec To Resolve Criminal Civil Charges Tied To Fake Accounts Scandal Cfcs Association Of Certified Financial Crime Specialists

Wells Fargo Settles 480m Class Action Brought By Investors Philadelphia Business Journal

Wells Fargo Unauthorized Accounts Class Action Settlement Top Class Actions

Wells Fargo Was Silent About Fake Account Probe For At Least 6 Months

Wells Fargo Held Fake Interviews With Diverse Applicants Nyt

Wells Fargo To Pay 3 Billion Over Fake Account Scandal

How To Get Your Piece Of The Wells Fargo Banking Scandal Settlement

Investors Closer To 500 Million Payout From Wells Fargo Settlement

Troy Harlow Has Always Made Sure To Pay His Mortgage On Time Wells Fargo Had Other Plans For Him

Wells Fargo Forced To Pay 3 Billion For The Bank S Fake Account Scandal